If you follow Tesla’s stock closely, you fall into one of 2 camps:

- Tesla is going bankrupt. Its cars are crap. It never delivers on its promises, the whole company is mismanaged, run by a con artist who has built a house of cards waiting to collapse. Elon Musk has no idea what he’s doing and his continued mismanagement is about to cause Tesla to crash and burn and its stock is on its way to $0.

- Tesla is an amazing company. It makes the world’s best cars. It continues to defy the odds, making cars deemed impossible by others, a reality. On its way to deliver a sustainable future, Tesla will own the transportation industry and become a Trillion-Dollar company. Elon Musk is a visionary, and key to Tesla’s success.

The two camps are polar opposites and each camp gets more convinced of its position with every passing Tesla announcement. But of course, only one of these narratives can be correct.

This article will answer the question: is Tesla destined for greatness or doomed to fail?

Before we can answer that, lets review some fundamentals…

The Stock Market

The stock market is a complicated beast and understanding it is beyond the scope of this article. However, it would be good to review 2 fundamental rules of the stock market:

- Rule #1: In the short term, a company’s stock price is a reflection of supply & demand. More buyers than sellers equates to a higher price for the stock. More sellers than buyers equates to a lower price for the stock.

- Rule #2: In the long term, a stock’s price will largely represent the fundamental value of the company. Revenues, profits and growth are the 3 key contributors to the long-term price of a stock.

Easy enough, but because of the significant fluctuations of the stock market on a day-to-day basis due to rule #1, many believe investing in stocks is the equivalent of gambling. That’s probably an accurate description for investors who have a short term horizon of days, weeks or even months. Without insider knowledge, its nearly impossible to predict a stock’s performance on a short-term basis and with insider’s knowledge, it’s illegal to trade a stock. So short term investing is a lot like gambling.

But unlike gambling in the casino where the odds are always in the house’s favor, short term investing in stocks can be manipulated by simply changing investor opinions. To understand how this is done, watch this video by one of CNBCs biggest anchors and a daily stock manipulator, Jim Cramer:

Crazy as it seems, its perfectly legal to sell a stock you don’t own (this is called “shorting a stock”), then spread crazy, unsubstantiated rumors about the company being on the verge of bankruptcy. Then when investors panic and sell the stock, you “cover” your short position by purchasing the stock again at a lower price than what you had sold it for. In summary:

- You sell a stock you don’t own (“shorting”)

- You spread misinformation about the stock to lower its price

- You purchase back the stock at a lower price

Tesla’s stock is currently one of the most shorted stocks in the stock market. More than 32 million shares of Tesla stock (about $8 Billion worth) are sold, for which the seller doesn’t own the stock. If you think this seems like some sort of crazy loophole scheme that some day we’ll look back at and wonder how this was ever legal, you’d be right. Short sellers have every incentive to spread Fear, Uncertainty and Doubt (known as FUD) about a stock in the hope that the stock goes down, ideally to $0 where they can purchase their shorted shares for a fraction of what they sold it for.

Not all investors gamble and bet on miserable outcomes.

The most successful investors generally have a long-term horizon of years, and they don’t generally gamble on anything. They evaluate companies based on fundamentals and future potential, then they invest in opportunities that have the highest potential return and hold on to the stock long-term.

This strategy is summed up in 1 sentence by the most successful investor of all time, Warren Buffett: “Our favorite holding period is forever.”

If you are a short-term investor, this article will have no value for you. I have zero knowledge of what Tesla’s stock will do in the coming days, weeks or even months.

But if you are (or considering to be) a long-term investor in Tesla, we should be able to answer the question of whether or not Tesla has a bright future…

Disruptive Technology and the Innovator’s Dilemma

In the late 90s, I read a book called The Innovator’s Dilemma. In it, Clayton Christensen describes why market leaders are often set up to fail as technologies and industries change. His brilliant book was later named “one of the six most important books about business ever written” by The Economist. Christensen argues that market leaders tend to maintain their leadership positions because of their market reach and power, until that is, there is a disruptive technology that comes along and over time unseats them from their leadership position.

An easy way to understand this concept is to look backwards at industries that had dominant players that changed. Examples would include companies like IBM who maintained their leadership in the computing world (despite heavy competition), until the PC disruption occurred. Kodak maintained their leadership in Photography until the digital disruption occurred. Microsoft maintained its massive leadership in software, until the Internet disruption occurred.

Leading companies maintain their leadership because they have name recognition, a distribution network, lots of financial resources to fight new competition, not to mention the experience to build great products that helped them become a leader in the first place. IBM knew how to make mainframes. Kodak knew film. Microsoft knew desktop software, and so on.

However, when a disruptive technology comes along, there is no established market for the new technology. Even when there is a market, it’s relatively small compared to the revenues of a market leader. Incumbent leaders see the new market as a distraction to their already established $20, $50, $100 Billion or larger businesses. Nobody has time to invest in and chase after a market that’s 1/100th their core business.

Therefore, disruptive technologies are often developed and improved by newcomers who see the potential. To a newcomer with $0 in revenues, $1 Billion is a great market opportunity to chase. To Ford, that’s 0.75% of their revenues. But once a new startup hits $1 Billion in revenues from a disruptive technology, they have major competitive advantage as they have been accumulating name recognition, a distribution network, the experience and talent to continue to be a leader in the disruptive category.

By the time Microsoft was a Billion-Dollar company, it was too late for IBM to dominate the new PC world. By the time Google became a Billion-Dollar company, it was too late for Microsoft to dominate the Internet world.

You get the idea. Lets move on to cars and Tesla…

The EV Disruption in the Car Industry

For nearly a hundred years, the US car industry has been lead by 3 automakers: Ford, Chrysler and GM. Internationally, they are joined by Toyota, VW, Hyundai, Nissan and small handful of others. For decades, these companies have fine tuned the art of designing, manufacturing, distributing and selling impressive cars that all rely on a fundamental marvel of engineering:

Harnessing the combustion of fossil fuels to power a transportation device.

For better or for worse, this pinnacle of human technology has helped humanity achieve unimaginable advancements that would not have been possible without the Internal Combustion Engine (ICE). But we also now know that ICE-based engines are responsible for huge amounts of greenhouse gasses that are rapidly warming earth and causing catastrophes around the globe.

For the past few decades, car companies had provided no real alternative to gas-powered vehicles, citing that electric cars are impractical, cost too much, and they are a niche market that nobody wants. They argued that electric cars end up being just as bad for the environment because they simply move the burning of fossil fuels from the vehicle to the power plant.

These excuses not to invest in electric vehicles, is the classic “incumbent leader vs. disruptive technology” syndrome.

It turns out that with the proper research and investment, electric cars are practical, they can be competitively priced, and they are far more efficient than gas-powered vehicles, even if the local power plant is burning coal! Most importantly, based on the success of Tesla’s Model S, X and 3, it turns out that they are not a niche market after all. Given a good choice, consumers would pick electric cars over their gas-powered counterparts by a wide margin. The way we know this is because all 3 of Tesla’s cars are leaders in their category and Tesla has shown that Electric cars can provide far superior performance, maintenance and joy of driving, than their gas-powered counterparts.

Tesla has Awakened the Giants

Great! Tesla has shown electric cars are in fact the future. All the major car companies now agree. Every major car company plans to completely revitalize their lineups with electric options. Finally! The giants have been awakened. With the enormous resources that these companies have (collectively near $1.5 Trillion in annual revenues), it’s game over for Tesla, right?

Well, not so fast. Disruptive technology is unkind to the incumbents. Turns out Kodak was a pioneer in digital photography in the 1990s and had the most advanced digital photography technology in the world before digital photography was even a thing. My first digital camera was a Kodak – it’s actually how I met my wife, but that’s a different story. Similarly, GM was light years ahead of its competition back in 1996 with the EV1. But when you have a $100 Billion+ business selling gas-powered engines, and all of your headaches are caused by the business unit that’s generating no revenues and is only costing your company hundreds of millions in investment, it’s easy to see why these companies would shut down their disruptive technology research!

The argument today is that the car companies finally see the potential, and this time around, they are throwing $10s of billions at electric car lines, so the results will be different.

Here is the problem: Imagine you are Ford. You build more than 1 million trucks per year and you want to offer an electric version of your truck. You can’t stop building the gas-powered trucks because that’s your current bread and butter. Without it, you will die. So you have to add a whole new lineup of trucks that are electric. After years of trying, Ford has learned the hard way, that virtually nothing about their gas-powered Truck-building knowledge translates to building an electric truck. Their designers have no experience designing trucks where the battery needs to be in the floor. Their engineers are Mechanical Engineers who build combustion engines and know virtually nothing about electric circuits and electrical components necessary to control electric flow into an electric motor. Even their manufacturing processes are not easily translatable to building battery packs. It turns out it’s so freakin hard, even for Ford, to build an electric truck, that it’s given up and instead invested $500 Million into an electric startup called Rivian.

And Ford is not alone. The Tesla Model S was released in 2012. Since then, it quickly became the top selling car in the luxury sedan category, destroying the sales of Mercedes’ S class, BMW’s 7 series and a handful of other luxury cars. Every one of those luxury brands has been promising an electric “Tesla Killer” that has yet to arrive.

The disruption of Electric Vehicles is here and real, but there are no guarantees that existing car companies can make, or even survive the transition to EVs.

If the EV disruption wasn’t enough to shake up the landscape, there are two other major disruptions affecting the car industry…

Car on Demand and Autonomous Vehicles

There is no question that ride sharing services like Uber and Lyft have completely changed and are disrupting consumer expectations for transportation. The convenience of having a car magically appear exactly where you happen to be, has even made many reconsider whether or not they need to own a car. If you can spend $500/month and have a Chauffeur drive you around everywhere, why would you buy a car that needs maintenance, pay for insurance, gas, and have the headache of driving when you could spend that time on a productive task?

Take away the driver, and you’ve eliminated the only negative in that equation. The risk of having a stranger drive you around, or to have to maintain an awkward conversation you don’t want to have is gone. The driver is also the highest portion of the cost for the trip. The holy grail of transportation is getting a car on demand using autonomous technology to get you to your destination. Safer. Cheaper. More convenient.

Every car company, as well as Uber, Lyft, even Google and Apple realize this is the future. The race is on – the only question is when and who will emerge as the winners.

While Uber and Lyft seem to have a technical advantage by already providing the exact same service, but using a driver, it’s counter-intuitive to realize that Uber and Lyft are actually at a major disadvantage to providing driverless vehicle services. Assuming they build the autonomous technology necessary to accomplish driverless trips, the cost of having to buy the vehicles, then upgrade them post-production to add autonomy, will mean their cost per vehicle will be significantly higher. But even worse is the fact that these companies employ hundreds of thousands of drivers who make a living on the Uber and Lyft network. There would be no ambiguity who the bad guys are if Uber or Lyft start to put these drivers out of a job. The same companies that were once hailed as Job Creators would become the villains that are now killing the very jobs they created. It’s unlikely that either Uber or Lyft will survive this transition, but fortunately for them, this transition will take years.

Then there is the car companies like GM, Ford, Daimler Benz and others who are investing billions in self-driving technologies. While car companies have a legitimate shot at building autonomous technologies, their expertise has never been in software development. Car companies are notoriously horrible at making software. Just look at how many taps, clicks and movements it takes to enter a destination address into any car navigation system. This is a problem that was solved by Google and Apple more than 10 years ago, yet for the past 10 years, none of the car companies have been able to figure out how to simply copy existing patterns for entering in an address into a navigation system. For these car companies to miraculously figure out computer vision, neural networks and all the other software technologies necessary for autonomous driving seems like an unlikely event.

The real competition for autonomous driving and car-on-demand is a 3-way race between Tesla, Google and maybe Apple.

Google seems to have the advantage here. It has had an autonomous research unit since 2004 and its Waymo car service is actually giving rides in production (with a backup driver). This advantage can’t be underestimated. Google also has the resources to buy 100,000 cars, equip them with autonomy, and put them on the road. Such an investment would cost Google, a company with nearly $100 Billion in cash, just $10 Billion to do. Although to get to 1 Million autonomous cars, it would require all of Google’s cash, nearly a $100 Billion investment. Doable for a company like Google, but certainly not cheap. Google is in an awesome shape in this race.

Then there is Apple. With the secrecy that Apple operates with, it’s unclear what Apple is planning, but we might be able to make some speculations. First, Apple definitely lags behind Google because they don’t have nearly as many cars on the road. Second, it’s highly unlikely Apple will choose to build its own cars. Manufacturing cars would take years, at least 3-5 years, to iron out. If they wanted to make cars, they would have had to start building plants a while ago. Apple’s best bet is to follow Google’s strategy, use its massive cash reserves to buy cars, outfit them with autonomous technology, and put them on the road. Under the leadership of Tim Cook, it’s unlikely this “me too” strategy of copying Google will work, especially if Apple’s other businesses ever have hiccups. If Apple sales ever decrease, the pressure on Apple would be to stay focused on its core business of iPhones.

And finally, there is Tesla. Tesla is probably far behind Google in Autonomous technology, but what’s impressive about Tesla is the rate of improvement. This rate of improvement is also accelerating because of the number of vehicles Tesla has on the market that are equipped with its self-driving hardware sensors. Lets do a little math…

For every car that is equipped with self-driving hardware:

- Google, Apple and others spend somewhere between $100,000 – $150,000 plus pay for a backup driver (for now)

- Tesla makes a gross profit of $10,000 – $20,000 (Model 3 or Model S/X) and gets a free backup driver (the owner)

This advantage for Tesla is absolutely insane. While others have to buy their cars, equip them with self-driving technology, then hire a backup driver to drive the car around, Tesla gets to sell its self-driving technology to its customers allowing its customers to finance the deployment of these cars all over the world, while it makes a profit on selling each one.

Think about that for a moment. In order for Google to put 1 Million self-driving cars on the road (after the technology is perfected), it will cost Google $100 Billion. Tesla on the other hand will make $10 to $20 Billion in profits by deploying a million self-driving vehicles. In fact, it’s already done exactly that by deploying around 400,000 cars that have the hardware sensors needed for self-driving. It’s already gathering data from 400,000 cars, and its doing so while making money from each of those cars!

More than the cost of the cars, Tesla has another major advantage. The AI and Machine Learning needed to perfect self-driving is heavily data dependent. The more cars you have on the road with the hardware sensors, the bigger variety of road conditions you encounter, and therefore, the faster the AI algorithms learn. Tesla has the largest fleet of cars, deployed in the widest array of geographical locations, giving it a major advantage for data collection to teach its algorithms how to drive. And it’s doing this without having to employ backup drivers or paying for the cars. Tesla’s backup drivers are the vehicle owners who paid full-price for the privilege of being a backup driver for Tesla’s autonomous AI going to school!

The Tesla advantage is incredible. Nothing like this has ever existed! This is a major disruptive advantage that no other car company in the world has. It’s also something that’s beyond the understanding of most Wall Street analysts. They have nothing to compare it to.

Tesla’s Autonomy Day

If Tesla’s future is so bright, why is it that so many Wall Street analysts have a “Sell” or “Underperform” rating on the stock?

Great question! Let’s dig into that.

Last week I had the fortunate experience of attending Tesla’s autonomy day. At the event, I had a chance to talk to several wall street analysts that cover Tesla. In my conversations, I realized a critical factor: Tesla is covered by “automotive analysts.” When I would ask about their thoughts on Uber or Lyft, they mentioned those stocks are covered by their “Internet analysts.” This is a huge discrepancy in viewpoints. The automotive industry hasn’t had major new players in many decades. Existing players go bankrupt regularly (GM, Chrysler, etc.). Their margins are extremely low and investing in disruptive technologies usually means making an SUV that can give 20 miles per gallon – not exactly a revolutionary disruption. It’s not that these analysts hate Tesla, it’s that they are comparing Tesla to Ford or GM and they have no idea why Tesla would be worth more. In their world, a car company doesn’t ever have a 10x increase in sales. Tesla is an anomaly that they don’t understand. Car companies are often valued at just 0.5x revenues because of their low profit margins. Tesla is valued at 2x revenues, so it appears way over-valued.

On the other hand, you have companies like Uber and Lyft being evaluated by “Internet Analysts.” As a result, despite the extremely low margins of Uber and Lyft, these companies are getting valuations that are 10x their revenues! In comparison, Tesla has a faster growth rate, higher margins, and a larger market potential, but is being valued (on a revenue basis) at about 1/5th the price!

Tesla’s self-driving technology is not yet perfect, but it’s pretty damn good:

Even if it takes Tesla several years to iron out the AI software, every year, it just keeps accumulating vehicles that all have self-driving hardware. Then with 1 Over The Air (OTA) update, all of them can become Robo Taxis overnight. Imagine a company that goes from having 0 Robo Taxis to all of a sudden having 1 million or 2 million Robo Taxis all over the world! Each one has the potential to add thousands of dollars to Tesla’s profits.

Elon Musk and Tesla Mistakes

Tesla and by extension, Elon Musk, have made their share of mistakes. Turns out great companies make mistakes all the time on the road to success. Some pay for them with punishments on the stock price…

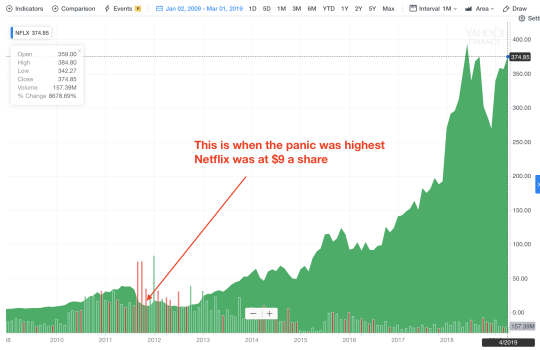

In 2011, Netflix announced they were splitting their DVD business and separately charging for streaming and DVD. The results were pandemonium. Wall Street analysts turned on Netflix. Short sellers cashed in on the panic and cited competition from HULU and Verizon – announcing the death of Netflix. They spend too much, have too much debt and not enough cash to live long. Sound familiar? As the stock price nose-dived from $40/share (split adjusted) to just $9 per share, it seemed like the panic was real and Netflix’s days were numbered. Just look at their stock chart during that period:

But of course, the panic was not real. The rumors of Netflix’s demise was just pure fabrication and despite so many people losing money for selling on the panic that was falsely generated, nobody ever went to jail! That’s what’s wrong with short sellers. They create a false narrative on purpose specifically with the intention of causing a stock to go down.

In the years that followed, Netflix continued to deliver quarter after quarter and eventually the false narrative of Netflix getting destroyed could no longer be supported. As a result, Netflix’s stock shot back up and has gone up more than 42x (that’s 4,200%!!!) since 2011 lows.

The arrow in this chart points to the right-most part of the chart above!

If you had invested $2,500 in Netflix when the Wall Street experts had turned on them with “Sell” ratings and journalists were predicting the end of Netflix, your investment would be worth $100,000 today!

Similar stories exist for Apple in 2000 under Steve Jobs, and Facebook in their first year of going public. Who remembers the headlines “Twitter is Dead” just a few years ago? The stock is up more than 200% since Twitter was declared dead. The examples are endless. When the foundation of a company is solid, irrational fears create opportunities to buy.

In fact, Warren Buffett has another great quote that applies here: “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Evaluating Tesla Rationally

So how can you tell if Tesla is truly over-valued and about to go bankrupt, or if it’s legitimately a great buy because of all the panic and fear that has been created? Great question. While we wait for all the Tesla Killer EVs to come out, let’s look at the facts around Tesla:

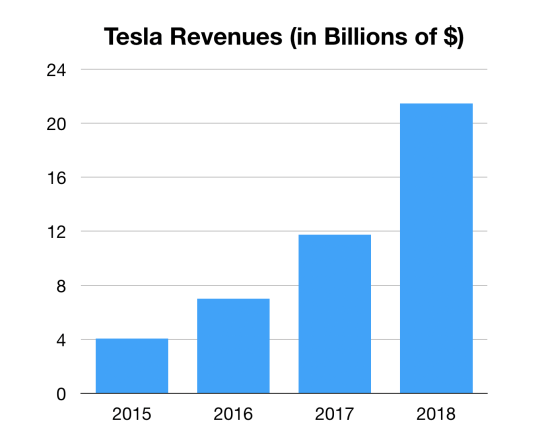

#1: Tesla Revenues have increased by 400% in 4 years!

No other public company in the world has had this kind of growth with similar numbers. In fact, Tesla’s awful, horrible, couldn’t get worse, Q1 2019 results generated more revenues than Tesla did in all of 2015! Tesla’s stock price is roughly about the same as it was in 2015. The stock has a ton of stored energy.

#2: Tesla has 3 cars, each of which are the #1 selling car in their category. Not by a small margin, but by a large margin! The Model S, X and Model 3 are all the best-selling cars in their respective categories, which is pretty incredible when you consider how few variations they have.

#3: Tesla Q1 2019, supposedly their worst quarter ever, had a year-over-year revenue increase of more than 33% and they made 110% more cars than the same quarter in Q1 2018.

#4: Tesla car owners are amongst the happiest, most satisfied and most likely to buy another Tesla, than any other car company! Have you ever spoken to a Tesla owner that said “oh man, I wish I never bought a Tesla?”

#5: The fastest super cars in the world have a hard time keeping up with Tesla’s 7 passenger SUV, but if that wasn’t bad enough for the future of gas-powered vehicles, the new Tesla Roadster 2 goes from 0 – 60 MPH in just 1.9 seconds!

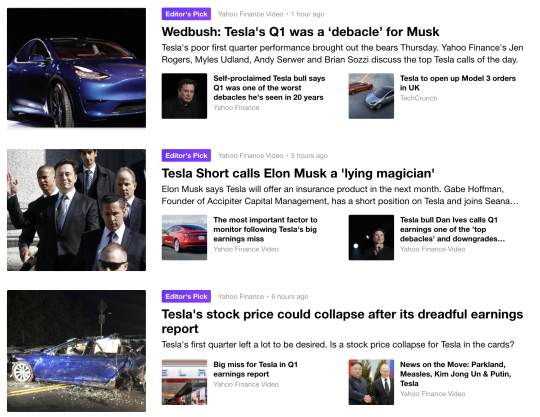

In the meantime, for the past 4 years that I have been following Tesla, these have been the headlines:

These headlines are just Friday’s top stories about Tesla on Yahoo Finance. Day after day, the stories on Tesla’s stock in the finance news pages are negative. Meanwhile, Tesla continues to defy the odds and makes products everyone else thinks it was impossible. The very same people who thought the Model S was not possible, then the Model X, then the Model 3, then producing 5,000 of them per week, are amongst the loudest critics still! Not a single one ever goes on CNBC and says “you know what, I was wrong – turns out, Tesla can make 5,000 Model 3s per week. I was wrong!” Yet, there they are, day-after-day, making their next bogus prediction of doom. You would think I made this stuff up. It’s crazy! Just watch this exchange between CNBC anchors and Cathy Woods (start at around 3:48 into it for the Tesla portion):

If Tesla continues to deliver with the Model Y, the Tesla Truck, Roadster 2, the Semi and other future cars, and there is little reason to think they wouldn’t considering their track record, Tesla will likely exceed $200 Billion in revenues within 10 years.

And that’s not even taking the potential upside of autonomous driving. If their dream of creating a Robo Taxis becomes a reality, their margins will easily double or triple during that same timeframe. When you combine these factors, Tesla has a shot to be a Trillion-Dollar company in 10 years. That would put their stock price at over $5,000/share!

I’m going to end with 1 more Warren Buffet quote: “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

P.S. I’m not affiliated with Tesla in any way. I’m just a tech investor (been doing it for 25 years) who has never seen a more crystal clear opportunity with a public company. In hindsight, it’s obvious that companies like Apple, Netflix, Facebook, etc. were going to be huge successes, but sometimes the FUD factor (Fear, Uncertainty and Doubt) that is created around companies by their competitors, journalists and “shorts” (those who bet against the stock then go out and make up lies and false rumors), causes stocks to have a mismatch between their value and their actual price.

And there’s this: