Once upon a time Steve Jobs was ridiculed by the pundits, and even Michael Dell himself (the king of the PC world at the time), for having such a naively simple plan to put Apple back on the map.

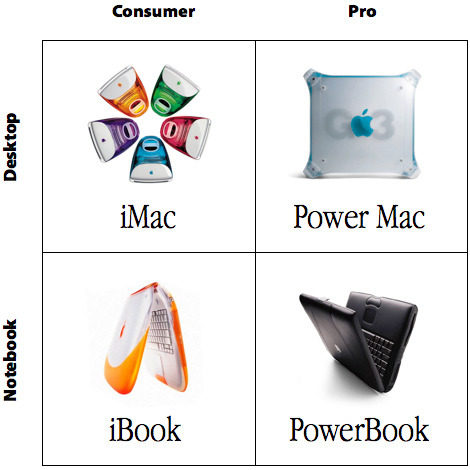

His plan was simple. He broke down all computers into 4 types: Consumer Desktops, Consumer Laptops, Pro Desktops and Pro Laptops. His goal for Apple was to have one fantastic offering in each of these 4 categories. It took Apple a few years from 1997 to fill each of the 4 boxes, but eventually Apple had its four boxes filled with the following:

The plan’s genius was not obvious to everyone. At the time Steve unveiled this plan, Dell, the king of the PC world, had over 100 different computer offerings. The pundits, analysts and competitors made fun of Jobs’ plans, saying it would be impossible to meet the needs of every type of PC user with just 4 different computers.

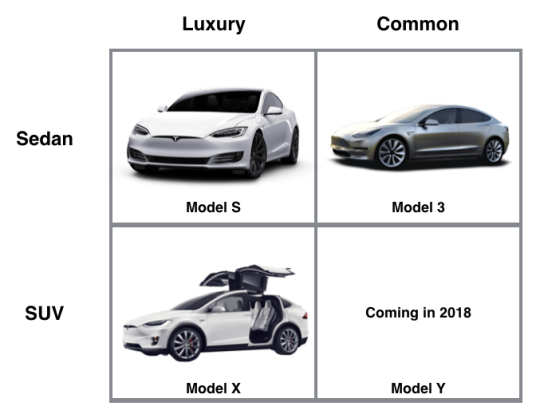

Fast-forward 20 years, and Elon Musk is deploying this exact plan on the car industry. Those who get it, have catapulted Tesla’s market cap past Ford and GM. The pundits, analysts and competitors, continue to be baffled by how this is possible, calling Elon Musk a con-man who stops at nothing to build a house of cards. They point to the delays in the original Model S or the Model X as validation for their arguments. They argue that the competitors are going to crush Tesla, when their fans wake up and realize the plethora of better options.

The words and phrases used to describe Elon Musk and Tesla are eerily similar to those used to describe Steve Jobs and Apple fans in the early 2000s. Apple fans were the illogical fanboys who acted like members of a cult, blindly following their beloved leader.

But to those who understand what is happening here, Tesla’s strategy is genius in its simplicity. While Toyota has become the king of the car industry with more than 80 different car models and has the rest of the car industry following in their footsteps, Tesla is taking a different approach: Make one fantastic car in each product category:

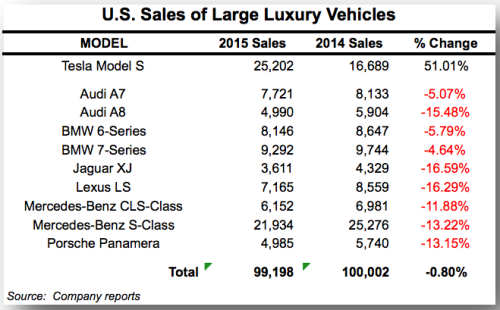

The Apple iMac launch in 1997 was a success, but it was nowhere near the success of the Model S. Tesla, in its first shot at the luxury sedan market, catapulted to the #1 auto-maker in the category, unseating the Mercedes-Benz S-Class.

While Mercedes had a 100-year head-start on Tesla, within 3 years of the Model S release, Tesla already owns a 25% market share, at the expense of all the other car-makers. The pie has not gotten any bigger. Tesla is just eating other car maker’s slices. All indications are that Tesla’s Model X is doing the same to the Luxury SUV market. With over 400,000 pre-orders for the Model 3, Tesla appears to be destroying it yet again in another product category. That’s 3 for 3!

What does this mean for Tesla’s Stock?

Even if you have great success in the marketplace, that doesn’t mean the stock price will follow. Sometimes, the price of a stock can get way ahead of its performance. And it’s true that Tesla’s stock is definitely ahead of its current revenue performance. But the stock market is all about future speculation of a company’s potential profits. If you had speculated that Apple would one day sell 200 million $700 iPhones per year when they first introduced the iPhone in 2007, you could have 10x your investment despite the fact that Apple’s stock was already ahead of its 2007 revenue performance. Likewise, if you had speculated that Netflix would one day have more than 100 million streaming subscribers (and maybe 500 million some day in the future), you would have 10x your investment in the past 5 years!

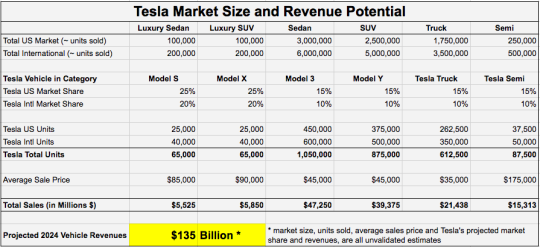

So lets speculate what Tesla’s future revenues could look like, say in 7-10 years. For that, I built an intentionally simplified spreadsheet, where I took a stab at approximate market size of each of 6 categories of car types. I then estimated the international market size to be approximately double that of the US market size. Finally, I took a stab at the approximate market penetration of Tesla’s vehicles in each category. It’s important to note that the US Luxury Sedan market share in particular is pretty close to accurate. All the other estimates are smaller than Tesla’s performance in the luxury class, so in my opinion, these numbers are actually quite conservative

Here is what it looks like:

LINK to Above Spreadsheet

(feel free to comment with more accurate market size numbers)

The next question is whether or not $135 Billion in revenues is possible? Is the market large enough to support a single company having $135 Billion in revenues? Well, it turns out the auto industry is larger than $1.5 Trillion per year! And companies like Toyota, GM and Ford have approximately $250 Billion, $166 Billion and $150 Billion in revenues individually! So $135 Billion in revenues would be less than a 10% market share and would still be below some of the largest automakers. I think Tesla has a shot at being larger than Toyota in 10 years, but lets stick to the conservative numbers.

I also happen to think that 4 disruptions in the auto industry will largely shift the advantage to newer car companies. These auto market disruptions include:

- The shift to Electric cars. This is clearly the unstoppable future and most car companies have already recognized that this is happening by planning their own electric models.

- The shift to software being the foundation of cars. This shift is hard to see for those who are not in the software industry. Yes, Toyotas and Fords also have lots of software in them, but they are mostly car companies with software slapped on top of the car. Tesla is a software company with a car wrapped around its software. Subtle, but important difference.

- The shift to car as a service. Services like Uber and Lyft are making car ownership less important.

- The shift to autonomous cars. When cars drive themselves, the same car can be owned by multiple people. Fractional car ownership will be a thing, making $50,000 cars affordable even in third world countries!

For those of us in tech, the way the car industry is playing out resembles a lot like the cell phone industry, where smartphone leaders like Blackberry and Microsoft, were rapidly replaced by iPhones and Androids. Remember when the hard-core Blackberry fans complained that “oh I can’t type on glass…I need to feel the keys being pressed!” Those same people now complain that “I need to hear the engine roar when I press the gas.”

The advantages that Tesla has over its competitors are enormous. It already owns the electric car market (with ~60% US market share of all-electric vehicles); it has the largest battery manufacturing facility; and the largest worldwide network of fast chargers. Imagine the advantage that Ford would have if it owned the majority of gas stations and no other vehicle could get gas from a Ford gas station. That’s the type of advantage that Tesla currently enjoys for electric vehicles! Not to mention Tesla is a software company and all of its current and future cars now have the hardware for autonomy. Its technical advantages are only going to get stronger.

And that’s just their vehicle potential!

Remember that other company Tesla bought, Solar City, that all the analysts were in an uproar about? The potential of doing another $30-$50 Billion in rooftop solar (~1 Million homes per year) is there. Plus augmenting power plants with battery power to even out power distribution (and lower brownouts and blackouts) has another $20 Billion+ potential. Tesla could see $200+ Billion in revenues in less than 10 years!

Unfortunately, like Amazon, Tesla will also not have much profits during that enormous rise. Building massive manufacturing facilities has its costs. As such, the nay-sayers will focus on the lack of profitability as the reason why the company will always be over-valued. But as a shareholder, I want Elon and company to be focused on future potential of profits, rather than optimizing profits for the short term. I would much rather Tesla optimize for 10 or 15% profit margins when it has $200 Billion in annual sales, and therefore $20-$30 Billion in profits, than when it has a mere $10 Billion annual in sales.

So what does a $200 Billion revenue company, that’s still rapidly growing, and profitable go for? About 2-3 times revenues or about 20-30 times profits. That puts Tesla at $400 Billion to $900 Billion market cap or about $2,400 to $5,400 per share!

Yes, I own Tesla stock. I’m not stupid!